As a business owner, you’re always balancing growth with cost — and taxes are a big part of that equation. In collaboration with our trusted distribution partner, Kelly Spicers, we’re breaking down two of the most valuable tax tools available when you invest in new equipment: Section 179 and bonus depreciation.

Both are designed to help businesses invest now while reducing their tax burden — but they work a little differently. Knowing how each one functions (and how 2026 updates affect them) can help you make smarter purchasing decisions with confidence.

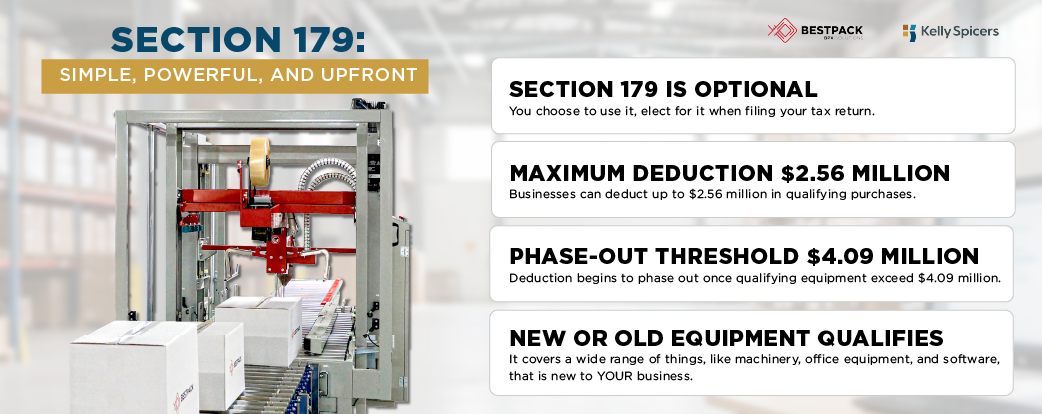

Think of Section 179 as a way to take a big tax win right away. Instead of spreading the cost of equipment over several years, Section 179 lets you deduct the full purchase price in the year the equipment is placed into service.

For many small and mid-sized businesses, that immediate write-off can make a real difference to cash flow.

Section 179 basics for 2026:

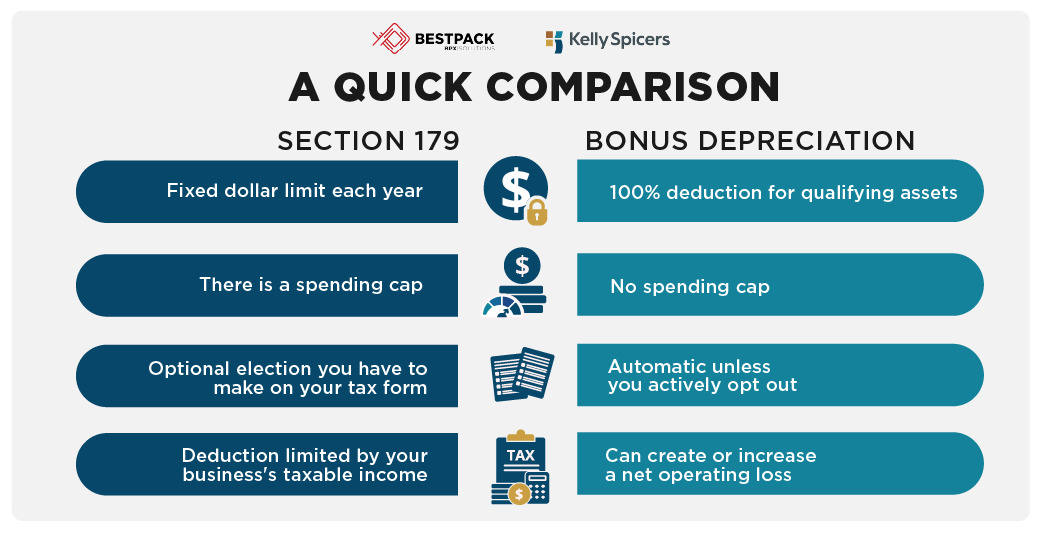

Bonus depreciation is another tool for first-year write-offs — and thanks to recent law changes, it’s back at full strength and here to stay. Under the latest rules, bonus depreciation for qualifying assets has been fully reinstated for recent purchases.

That means if you have remaining cost after Section 179, you can usually deduct the rest in the same tax year, even if your total spending goes well beyond Section 179’s limits. There’s no spending cap and it applies to both new and used property (as long as it’s new to your business).

Bonus depreciation in 2026:

Bonus depreciation rules have changed several times in recent years, so it’s always smart to confirm the current rate with your tax professional.

Understanding these two side by side can help you choose the right approach for your situation:

The good news is you don’t always have to choose between Section 179 and bonus depreciation. Many businesses use both to maximize first-year tax deductions on equipment purchases. A common strategy is to apply Section 179 first (up to the annual limit) and then use bonus depreciation on any remaining cost.

This approach allows businesses to take advantage of immediate tax savings while staying flexible based on taxable income and long-term planning goals.

In general, Section 179 works well for businesses making a manageable number of equipment purchases and looking for predictable tax savings. Bonus depreciation may be a better fit for businesses making larger investments, expanding operations, or purchasing high-dollar equipment.

Because tax situations vary, the best approach depends on your business income, purchase size, and growth plans. A tax professional can help determine the most effective strategy for your specific needs.

Here’s the bonus on top of the bonus:

Taking advantage of tax deductions like Section 179 doesn’t prevent you from using other savings opportunities.

When you purchase qualifying equipment, you can often combine tax deductions with BestPack’s current promotions, helping you reduce taxable income and lower your upfront investment.

👉 View current offers at promotions.bestpack.com

What is Section 179?

It’s an IRS provision that allows businesses to deduct the full cost of qualifying equipment and software in the year it’s placed into service, rather than depreciating it over several years.

Is Section 179 permanent?

Yes — Section 179 is a permanent part of the tax code. However, the annual deduction limits and spending thresholds are adjusted for inflation and may change year to year.

What’s the deadline to use Section 179 for 2026?

Equipment must be purchased (or financed) and placed into service by December 31, 2026 to qualify for that tax year.

Can laws change again?

Yes. Tax laws evolve, which is why it’s important to confirm current limits and rates with your tax advisor before making large purchasing decisions.